At BNT Diamonds, we have committed ourselves to offer our customers the best possible price-quality ratio. To accomplish this goal we invest in efficiency and do everything possible to avoid unnecessary intermediaries.

BNT Diamonds - The Diamond Investment Office

- Amsterdam

- Antwerp

- Düsseldorf

- Geneva

- Hong Kong

- Knokke

- London

- Mumbai

- Munich

- Paris

- Shanghai

- Zürich

Why choose for BNT Diamonds?

Unbeatable Price-Quality

Diamonds at the Source

All our diamonds are bought at the source, without intermediaries, at the best possible conditions, resulting in a significantly lower price for all our clients.

Personal Approach

Each potential client will have a dedicated & experienced contact person throughout the entire process. We are convinced that our accessible & customized client approach, in all discretion, will strongly add to your comfort.

100% Transparency

Trust is of great importance within the diamond industry and can only be earned through transparency and honesty. Since its establishment, BAUNAT has built an excellent reputation through excellence of service and due diligence.

Ready to start investing in diamonds? Contact our team of diamond experts for professional advice tailored to your investment profile.

About BNT Diamonds

BNT Diamonds, member of the BAUNAT Group, is the worldwide reference for diamond related purchases & investments. Through our established supply network of dedicated diamond manufacturers, we have the unique capacity to buy diamonds at the very source. This edge is directly reflected in our exceptional diamond prices. To the benefit of all our valued clients, spread across the world.

Our team of highly qualified and experienced professionals provides extensive diamond knowledge and guidance, to corporate and private investors/buyers. Furthermore, we offer a wide range of specialist services to investors who want to add polished diamonds to their investment portfolio in order to increase its profitability, diversity & stability.

BNT Diamonds’ mission is to maximize the future profitability of our clients’ diamond purchases or investments. We do this by being as efficient as possible in all areas and avoiding unnecessary aspects in the supply chain.

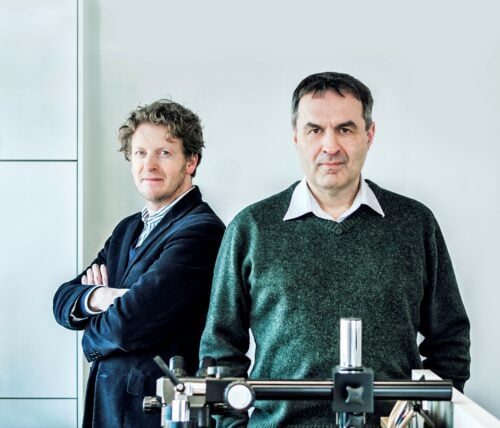

- Stefaan Mouradian & Steven Boelens

Diamonds are a resilient long-term investment, providing stability and growth. Diversify wisely to safeguard your assets and unlock the full potential of your investments.

Stefaan Mouradian & Steven Boelens

Investment options

BNT Diamonds provides 4 investment options. Each option offers a tailored service package according to the specific needs of our clients. Smart purchasing empowers us to offer unmatched prices challenging the entire diamond industry.

1. Browse our list of available diamonds

With the ability to create the largest selection of certified diamonds in the world, we offer the 10 classic diamond shapes, starting at 1.00 ct. All our diamonds are of the highest quality, conflict-free, and certified by a leading, independent, and internationally recognised diamond laboratory, such as GIA, IGI, or HRD.

2. Request a quote for a specific diamond

If you can’t find your desired diamonds to invest in from our selection of certified loose diamonds, you can always request a quote for a specific diamond through our digital form.

3. Request a personalised investment package

At BNT Diamonds, we also offer packages of certified loose diamonds to meet your specific investment requirements and budget. We offer these diamonds at the most competitive prices in the entire diamond industry.

4. Choose from our selection of "Special diamonds"

All diamonds are valuable and unique, but some are rarer than others. And then there are the exceptionally rare diamonds, called “Special Diamonds”. Whether a diamond falls into the “Special” category depends on various factors, such as carat weight, clarity, cut and colour.

Start to invest

Get in touch with our team of diamond experts or make an appointment in one of our showrooms worldwide.